FINANCIAL EXPERIENCE

What Atlas Does For You

You link your accounts with Plaid. Atlas does the rest. It analyzes your income, expenses, savings, and goals to build your Atlas Score—your personal financial readiness number. Then it gives you the next best step to improve it.

Smart Financial Management

Automatically categorizes your spending and builds a real-world budget based on your actual bills, not theoretical numbers.

Goal Setting & Tracking

Helps you set financial goals and crush them with personalized strategies designed for your military lifestyle.

Atlas Score

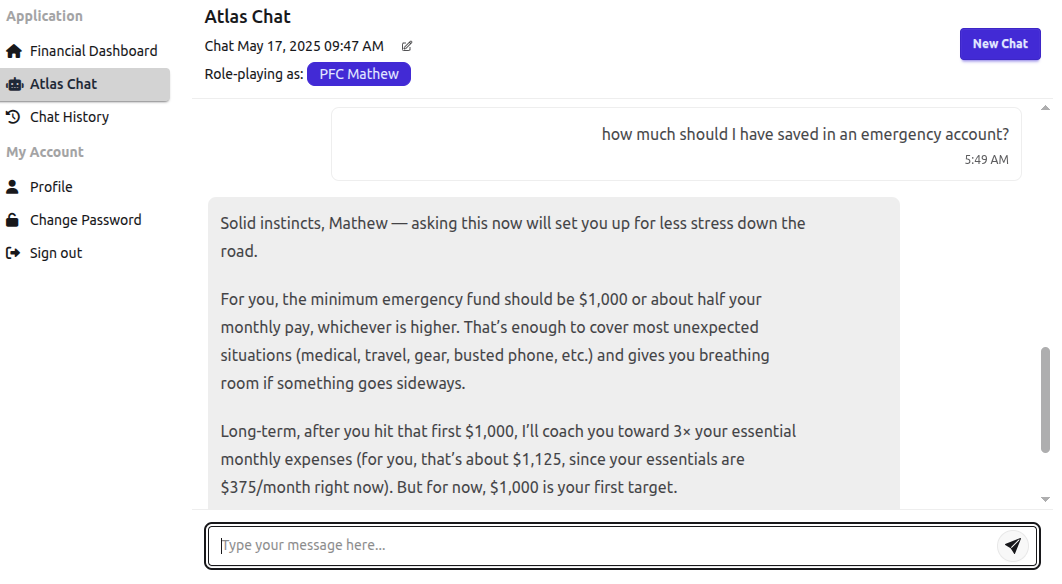

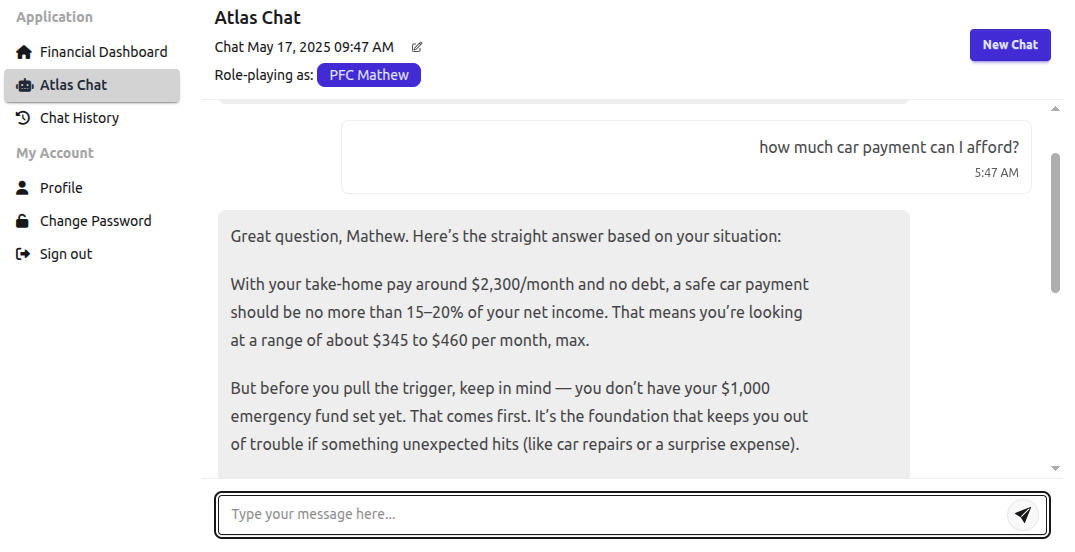

Scores your financial readiness using the Atlas Score and coaches you like a mentor—every step of the way.